Basics of LOMRs

LOMRs represent the bulk of our business. However, most property owners, land developers, and even engineers don’t know what a LOMR is, much less how to go about performing one. Therefore, please see our brief tutorial below regarding the basics of LOMRs (click here for a list of Definitions of Commonly Used Terms and Acronyms in the Field of Floodplain Management).

What is a LOMR?

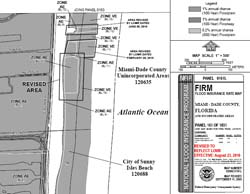

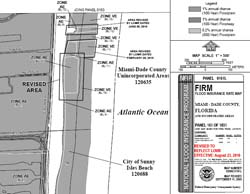

A LOMR (Letter Of Map Revision) is a detailed, technical application that is performed and submitted to the local Floodplain Administrator (FPA) and FEMA for review and approval. A LOMR changes one or more floodzones, Base Flood Elevations (BFEs), or Wave Crest Elevations (WCEs) on FEMA-issued Flood Insurance Rate Maps (FIRMs). A LOMR can also move or change the location of the Limit of Moderate Wave Activity (LiMWA) line on floodmaps; this is especially important for building and construction permitting, as any proposed structure seaward of the LiMWA line must be constructed to “V” floodzone standards. We can even determine new BFEs for existing “A” floodzones with no corresponding BFEs (un-numbered “A” floodzones).

Why are LOMRs Feasible?

LOMRs change “V” floodzones to “A” or “X” floodzones, “A” floodzones to “X” floodzones, or reduce BFEs or WCEs. Unfortunately, many effective FIRMs in existence today that determine flood insurance rates contain floodzones or BFEs that are erroneous or antiquated. Many Florida FIRMs were originally created using large-scale, county-wide data that did not incorporate fine or “site-specific” data into the modeling and mapping of the corresponding floodzones. Additionally, many Florida FIRMs utilized data that may no longer be accurate due to new construction and recent changes in land-use, shoreline location, and topography that have occurred since the FIRMs became effective. A LOMR revises the effective FIRM, changing floodzones and/or BFEs or WCEs, based on more accurate, site-specific data used in the modeling and mapping procedures. We have found that when a property is located within an inaccurate FIRM, a LOMR can be performed at least 75% of the time.

Why are you paying so much money for Flood Insurance?

Flood insurance for habitable structures can be obtained from either the publicly-funded National Flood Insurance Program (NFIP) or Private market insurance companies offering flood insurance policies to clients. For NFIP (Risk Rating 2.0) policies, annual premiums are derived from an extensive algorithm/equation that considers inputs from about two dozen components – including topography, distance to flood source, flood elevations, and construction criteria/standards used to build the subject structure. It is important to note that with the new Risk Rating 2.0 system, floodzones are no longer considered in the NFIP rating process for flood insurance. With the new Risk Rating 2.0 system now in place, some policyholders saw decreases in their annual premiums while others saw increases. Many of those who saw increases lost their previous FEMA “grandfathering” privileges, as this key savings component was permanently eliminated with implementation of Risk Rating 2.0. Moreover, the federal law requiring mortgage-backed properties to purchase flood insurance in both “V” and “A” floodzones is still in effect.

For privately-funded flood insurance policies, flood insurance is still based chiefly on two criteria – what floodzone your property is located within, and the difference between the BFE/WCE and your structure’s lowest finished floor (in “A” floodzones) or lowest horizontal structural support beam (in “V” floodzones). Flood insurance has always been expensive for structures located within “A” and “V” floodzones, but annual rates have increased appreciably since the early 2000s. These increases were due to flood damages/claims caused by several hurricanes since 2005 – chiefly Hurricanes Katrina, Ida, Sandy, Harvey, and Irma. As such, many privately-funded policies have increased by an average annual rate of 5-20% over the past several years.

Even with the new Risk Rating 2.0 in effect now, NFIP policies only cover losses up to $250,000 per for flood damage to your dwelling/unit and attached items. Private market flood insurance policies, however, can cover much larger dwelling values. An example we see very often is a significantly under-insured High-Rise condo building. If a new High-Rise condo building opens with 100 total units, the maximum NFIP coverage that can be obtained is $250K x 100 units = $25M. But the actual replacement cost of this new building is listed at $50M. That means with the NFIP, this building would be uninsured by 50% in the event of a significant or total loss due to a flood event, leaving the remaining $25M in re-building costs to the unit-holders! In this example, an “excess” Private flood insurance policy would be needed to cover the huge difference. Coverage limits may be the most obvious difference between NFIP policies and Private market options, however, there are also some other key differences. In particular, you can see some big differences in price, documentation requirements, deductibles, and even in the way coverage applies.

How much money can you save with a LOMR?

Any property located in an “A” or “V” floodzone would benefit financially from a LOMR. Below are a few examples:

Example 1:

NFIP Policy, “A” floodzone (small home or small condo building) – A property owner receives a maximum of $250,000 in replacement cost coverage for their dwelling, mortgage-backed policy costing $10,ooo per year. With a LOMR performed that changes the floodzone from a high risk “A” floodzone to low risk “X” floodzone, this policyholder can now legally drop his/her flood insurance policy (if desired) and save $10,000 per year, as the mortgage-backed flood insurance requirement would be eliminated!

Example 2:

Private Policy, “VE-12” floodzone (large High-Rise condo) – A condo association obtained an NFIP policy to cover the first $25M of replacement cost coverage, and an additional “excess” Private market policy to cover the second $25M of replacement cost coverage. Since the property is located in a VE-12 floodzone, a LOMR into an AE-11 floodzone will not reduce the NFIP policy cost, due to the new Risk Rating 2.0 system. However, the LOMR would reduce the cost of the “excess” Private market policy, since these policies are still based on floodzones/BFEs. We have found from previous clients’ LOMRs that Private market reductions in flood insurance costs normally range from about 25% to as much as 4x (depending on various factors and how the policy was written) – meaning an annual $100K Private market flood policy in a VE-12 floodzone would be reduced to between roughly $25K to $75K per year with a LOMR into the AE-11 floodzone!

Example 3:

New Inland Construction, standard “AE-8” floodzone (10-acre site) – For this developer of a vacant 10-acre parcel within an “AE-8” floodzone, a LOMR that reduces the BFE to 7 feet, or changes the “AE” floodzone would save tens to hundreds of thousands of dollars in imported fill. For example, let’s assume that 5 acres of the particular 10-acre parcel is to be developed with buildings, and each of the lowest floors of these buildings would need to be constructed to at least 1-ft above the 8-ft BFE. If a LOMR is performed that changes the floodzone BFE from “AE-8” to “AE-7”, one foot of fill over the 5 acres would be saved. This savings of one foot of fill over 5 acres would yield an approximate construction cost savings of $24K per acre, or about $120K of total savings (based on an approximate cost of $15 per cubic yard of imported fill)!

Example 4:

New Coastal Construction, coastal “AE” floodzone – This developer is proposing a new hotel resort seaward of the Limit of Moderate Wave Activity (LiMWA) line, also known as a coastal “AE” floodzone. As such, all the buildings of this new site would be required to be developed to “VE” floodzone standards. With a LOMR that moves or changes the location of this LiMWA line further seaward, the developer saves tens to hundreds of thousands of dollars in construction costs, as the site could then be constructed to standard “A” floodzone regulations (use of concrete piles, special foundation, breakaway materials, VE floodzone certification all no longer required)!

Who Benefits Most From a LOMR?

The following is a list of the most common properties that benefit most from having a LOMR performed:

The following is a list of the most common properties that benefit most from having a LOMR performed:

- Developers/Builders of vacant lots

- High-Rise/Low-Rise Condominiums

- Hotels/Resorts

- Shopping Centers/Malls

- Residential Homeowners’ Associations

- Apartment Buildings

- Office/Commercial Buildings

- Single-Family Homes

- Waterfront Structures (marinas, ports, etc.)

By having a LOMR performed, the property owner could achieve the following benefits:

By having a LOMR performed, the property owner could achieve the following benefits:

-

Significantly reduced annual flood insurance premiums for Private market policies

-

No longer forced to obtain flood insurance (in “X” floodzones) for mortgage-backed properties

-

Fewer construction/building permits required; more cost-effective construction options for development in Special Flood Hazard Areas

- Reduce amount of structural “fill” needed to elevate buildings in an “A” floodzone

-

Turn an un-developable property into one that is developable (removal/reduction of a Regulatory Floodway)

-

A significant increase in property value and “sell-ability”

What if a LOMR is not feasible or is not cost-effective?

Sometimes LOMRs are simply not feasible or cost-effective to do. In cases where a property is located within a “V” or coastal “A” floodzone and cannot have a LOMR performed, a viable alternative is a CLOMR (Conditional LOMR). Where it is possible to reconstruct an existing seawall/bulkhead, or construct a new one, or add additional fill to the site to raise it above the BFE, a CLOMR would allow for a LOMR to be approved when the “proposed” conditions are certified as an “as-built” survey.

Sometimes LOMRs are simply not feasible or cost-effective to do. In cases where a property is located within a “V” or coastal “A” floodzone and cannot have a LOMR performed, a viable alternative is a CLOMR (Conditional LOMR). Where it is possible to reconstruct an existing seawall/bulkhead, or construct a new one, or add additional fill to the site to raise it above the BFE, a CLOMR would allow for a LOMR to be approved when the “proposed” conditions are certified as an “as-built” survey.

In cases where properties are located within “A” floodzones and cannot have LOMRs performed, a viable alternative is a LOMA or LOMA-F (a LOMA based on Fill used to elevate the structure). Issued by FEMA, a LOMA removes a structure – not a property – from an “A” floodzone. LOMAs are often less “technically intensive” than LOMRs; hence, they normally cost less than LOMRs to perform. LOMAs are only feasible for properties in “A” floodzones and are based on the structure’s most recent Elevation Certificate. With a LOMA, the property owner would no longer be required by law to obtain flood insurance for the mortgage-backed building.

In all cases, we always perform a cursory LOMR or LOMA Feasibility Analysis, free of charge, in order to determine for sure if the revision is feasible. We will NEVER have you sign a contract with us to perform a LOMR unless we are confident we can perform the job accurately and efficiently and get the job approved!